What is FinanceOps?

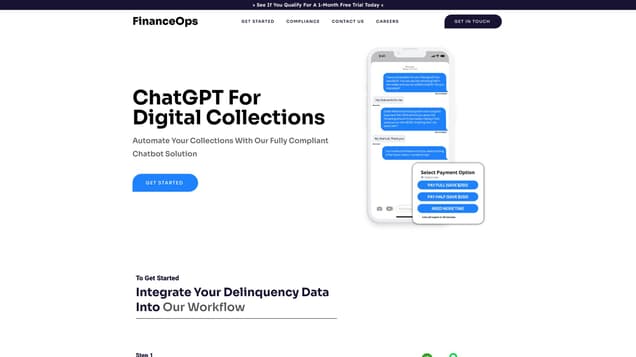

FinanceOps is a comprehensive financial operations platform that specializes in automating collections processes. The platform features a compliant chatbot solution, which seamlessly integrates with popular ERP tools. By utilizing advanced algorithms, FinanceOps optimizes collections strategies to achieve maximum results. Its primary objectives include streamlining collections procedures, providing personalized interactions, minimizing overhead costs, handling higher volumes efficiently, and ensuring strict adherence to US debt collection regulations.

Information

- Financing

- $220.00M

- Revenue

- $5.70M

- Language

- English

- Price

- Free

Freework.ai Spotlight

Display Your Achievement: Get Our Custom-Made Badge to Highlight Your Success on Your Website and Attract More Visitors to Your Solution.

Website traffic

- Monthly visits2.11K

- Avg visit duration00:13:38

- Bounce rate29.07%

- Unique users720

- Total pages views19.58K

Access Top 5 countries

Traffic source

FinanceOps FQA

- How can I integrate my delinquency data into FinanceOps?

- What data mapping and configuration is required for FinanceOps?

- What collection settings can I customize in FinanceOps?

- How does FinanceOps optimize the collections process?

- What are the benefits of using FinanceOps for collections?

FinanceOps Use Cases

Automate collections process by integrating delinquency data from ERP tools such as QuickBooks, Xero, Sage, NetSuite, Salesforce, etc.

Ensure accuracy and integrity of shared data through data mapping and configuration for reliable performance

Customize collection settings to personalize the approach and meet specific needs

Launch Autopilot and engage with customers using advanced algorithms and personalized strategies

Streamline collections processes, delivering targeted interactions and reducing overhead expenses

Scale collections process to accommodate increased volumes

Ensure compliance with US debt collection rules and laws, including FDCPA, CPA, and CCPA

24/7 support on collection inquiries via SMS

Access live agents for handling call requests from customers seeking to escalate collection matters

Offload the heavy burden of collections and focus on core business activities