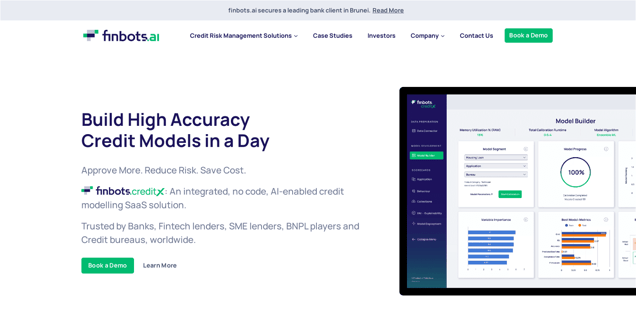

What is Finbots?

Finbots is an advanced credit modelling solution that utilizes AI technology to assist lenders in making informed and inclusive lending decisions. By leveraging its integrated and powerful features, Finbots empowers users to swiftly develop highly precise credit models within minutes, resulting in reduced risk and significant time and cost savings. Through Finbots, lenders gain access to a diverse range of data, enabling them to accurately evaluate potential borrowers and make well-informed choices.

One of the key advantages of Finbots is its user-friendly interface, which allows lenders to effortlessly generate credit scores and models for their customers. These models are powered by cutting-edge machine learning algorithms, enabling lenders to swiftly identify applicants with a high-risk profile and take appropriate actions accordingly. Moreover, the platform offers customization options, allowing lenders to tailor the models to suit their specific requirements.

The primary objective of Finbots is to facilitate lenders in making faster and more accurate decisions, ensuring optimal outcomes for their customers. By utilizing its intuitive tools, lenders can mitigate risk and enhance their financial performance, while simultaneously granting access to credit for individuals who may otherwise face denial.

Information

- Price

- Contact for Pricing

Freework.ai Spotlight

Display Your Achievement: Get Our Custom-Made Badge to Highlight Your Success on Your Website and Attract More Visitors to Your Solution.

Website traffic

- Monthly visits791

- Avg visit duration00:00:28

- Bounce rate82.67%

- Unique users--

- Total pages views1.24K

Access Top 5 countries

Traffic source

Finbots FQA

- Who is the CEO of Sathapana Bank?

- Which country did finbots.ai sign a new client in?

- What is the main product of finbots.ai?

- What are the benefits of using CreditX?

- What is the purpose of AI Verify Foundation?

Finbots Use Cases

Credit risk management for EDOMx in Nairobi, Kenya

Credit risk management for Samunnati

Credit risk management for EDOMx in Nairobi, Kenya